Highlights:

- World Pork Expo 2021 and Pre-WPX event in Des Moines

- Live hog price in China reaches a new low at RMB 15/kg, down nearly 60% this year

- Cash hog price has not bottomed out amid strong hog recovery and low pork demand

- Why public hog firms continue to expand even at a loss

- Upcoming Webinar: A Look at China’s Largest Producers

[Greene County IL, June 11] Today is the third and final day of World Pork Expo 2021 in Des Moines, Iowa. This is the first WPX in three years. In 2019, the annual pig industry event was cancelled due to African Swine Fever (ASF). Last year, it was cancelled again because of COVID19. For many of us, this is the first major event we attend with thousands of people around since the pandemic.

During a pre-Expo event on June 8th hosted by Joe Kerns, keynote speakers from US Meat Export Federation and Cargill presented their views on the outlook of US pork industry. The main theme was China. It’s being considered the biggest unknown risk: the elephant in the room that could stampede the Bull Run in hog and corn prices at any given time.

I responded to these concerns and held a sit-down panel with PFPAg later in the evening. In a nutshell, China’s hog price is primarily driven by the Hog Cycle. It is entering its final stage, characterized by increased supply and downward price trend.

If you look at the right place, there are vast amounts of information pertaining to China’s hog industry. My primary focus is market data, which includes cash market prices, futures market prices and stock prices of publicly traded hog firms. With thousands of institutions and millions of retail investors active in the market, price data is remarkably efficient. Rather than being fooled by ungrounded conspiracy theory, you could form an intelligent assessment based on in-depth analysis of market data and key factors impacting it.

Cash Market: Hog price reaches a new low at 15 yuan

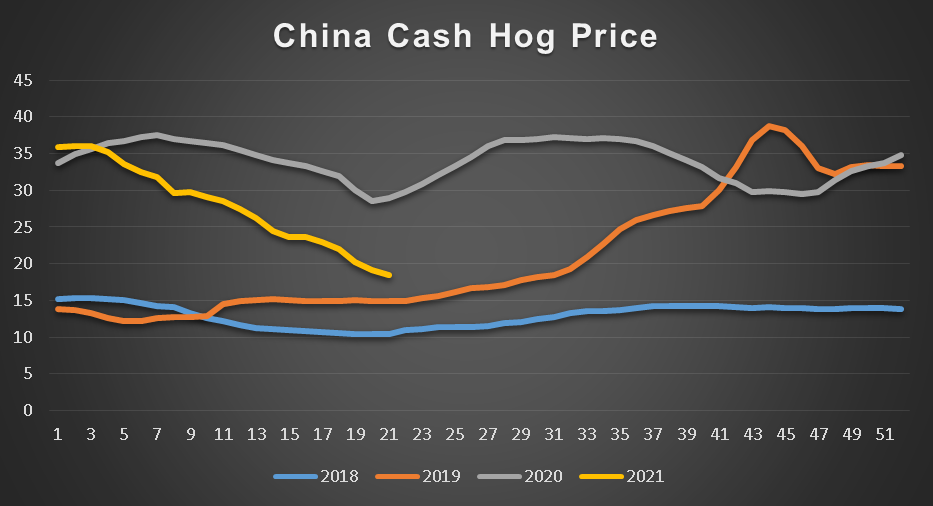

Based on market data tracked by CACDA, China’s national average live hog price is RMB 15.05 per kilogram today (equivalent to $1.05 per pound, US$1≈6.40 yuan). Current cash hog price represents a whopping 21.6 yuan drop (-59%) from the January 8th high of 36.61.

The latest USDA Daily Hog and Pork Summary quotes Negotiated Barrow and Gilt in the price range of $101.80 – $132.00 cwt, with national weighted average price at $119.72. This is the first time when hogs in China are selling below US price levels.

(Data Source: Ministry of Agriculture and Rural Affairs)

In my opinion, the downward price trend for four months straight is driven by improved hog supply and low pork demand. This is consistent with the late stage of a Hog Price Cycle. More hog inventory, bigger market hogs, huge frozen pork import, liquidation of cold storage and panic sales by farmers all reinforce the vicious downward spiral. Hog price would not reach bottom until pork demand comes back in September.

With a negative spread between China and US pork price, China would likely reduce frozen pork import in the second half of the year. Presently, China Customs imposes an 8% import duty and 9% VAT tax on frozen pork. Pork import could no longer turn a profit with rising cost and fall price. Pork originated from the US has a special treatment. During the height of the Trade War, import duty was raised three times to 72%. With the signing of Phase 1 US-China Trade Agreement in January 2020, import duty is now down to 33%, plus the 9% VAT. The headwind for US pork export is no longer the unpredicted government policy, but purely economic forces at work.

Futures Market: DCE Hog Futures Reaches new low since debut in January

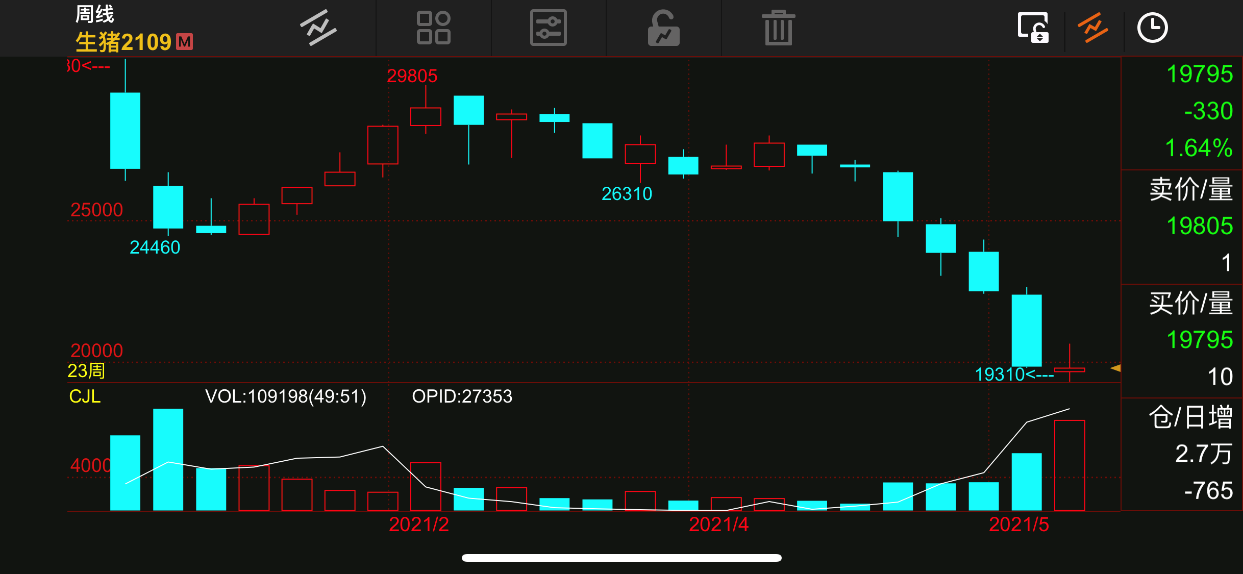

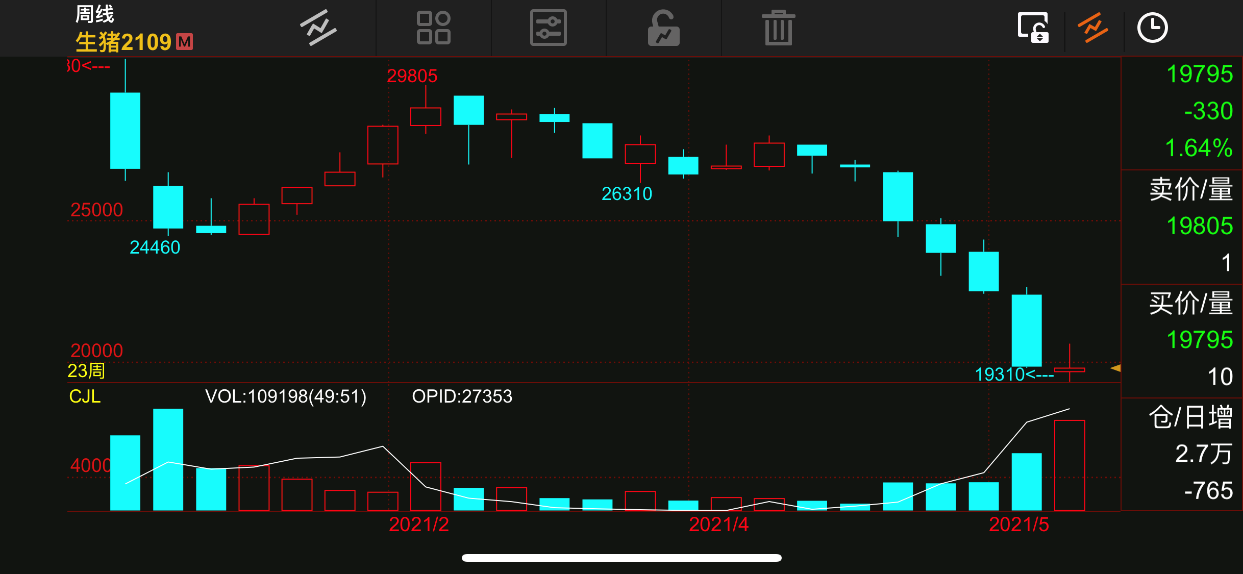

Today, the front-month September contract of DCE Live Hog Futures closed at 19,795 (quoted as RMB per metric ton). It is down 10,010 points, or 34% from its peak of 29,805 on February 22nd.

(Price chart courtesy of WH Financial)

September contract is trading at 4.7 yuan above cash market price. This is consistent with my forecast as pork consumption typically increases during Mid-Autumn Festival and October 1st National Day holidays. However, futures market disputes the notion of pork shortage. All contract months closed below the psychologically important 20-yuan mark today. November, January, March and May contracts settled at 18745, 19650, 18675, and 18730 respectively.

Stock Market: Hog firm market value continues to fall amid low price and record sales

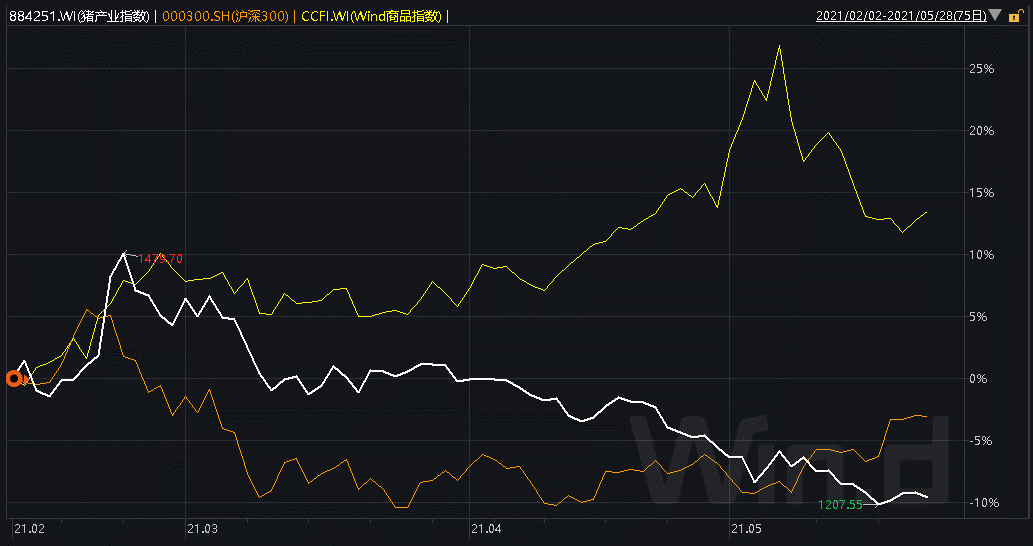

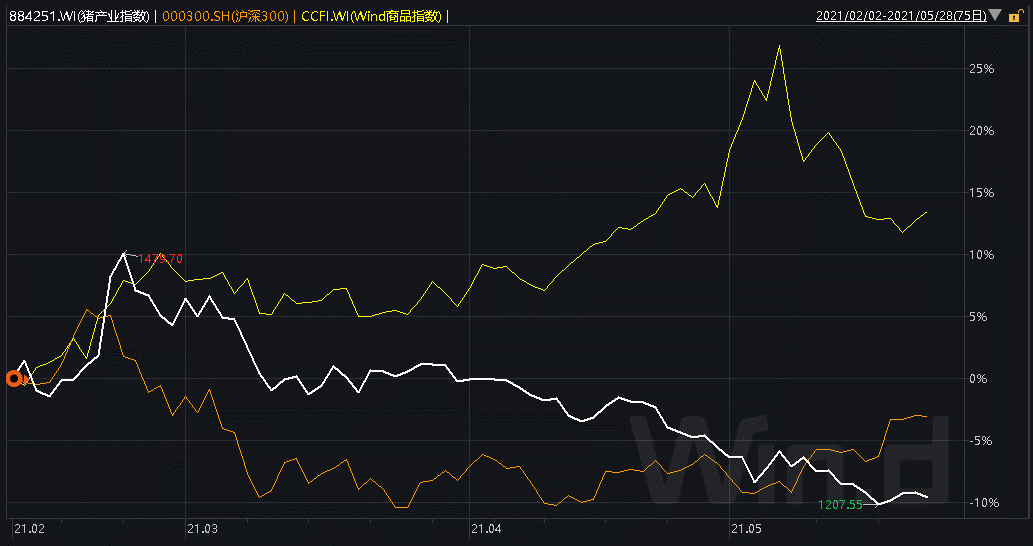

China’s Wind Hog Industry Index (884251.WI) closed at 1167.36 on Friday, down 35.6% from its 52-week high of 1813.27. This market weighted index of publicly traded hog firms is widely considered a forward-looking barometer of China’s hog industry.

The Hog Industry Index (shown as a white line in the chart below) underperformed the CSI 300 stock market index (brown line) by 8%, and was 23% below the Wind Commodity Index (CCFI.WI, yellow line), which tracks all major commodity prices in China.

(Price chart courtesy of Wind Financial)

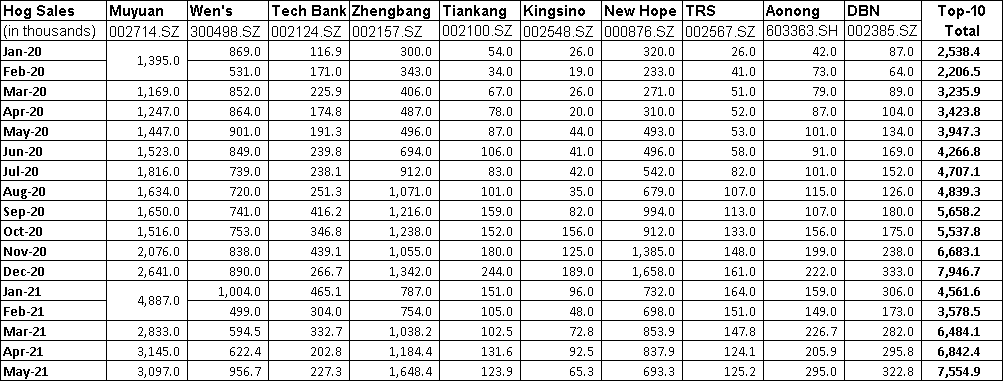

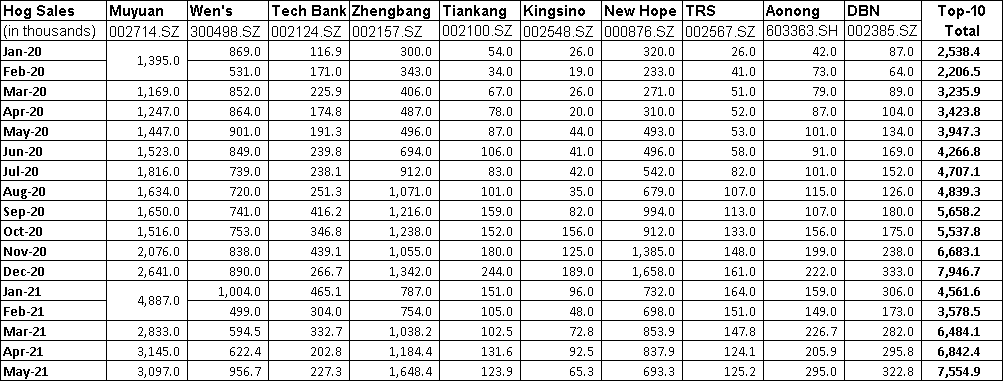

Hog sales data released by public firms supports the assessment of strong hog stock recovery. In the first five months of 2021, China’s Top-10 hog firms together sold 29.02 million hogs, up 89% from the same period last year. Most big hog firms saw their hog sales double or even triple.

(Data source: public company releases)

Why public hog firms continue to expand even at a loss

Many people expects hog farmers to exit the market as hog price enters production loss territory. This may be true for small family farms. However, publicly traded firms and large state-owned enterprises continue to expand at a rapid rate. With this sector now accounting for 15%-20% of China’s hog output, their behavior significantly alters the industry landscape and warrants a close examination.

Firstly, public firms have easy access to low cost capital by raising billions in the equity and debt markets. Many started a 5-year expansion spree in 2019 and 2020 when high hog price seems to last forever.

Secondly, these hog firms already incurred large investment on the book in the form of building-in-progress. If they don’t see through the completion of new facilities, they would face massive write-offs.

Thirdly, public hog firms now face a dilemma. With hog price taking a nose dive, they no longer have the profit to service their debts and support the expansion. However, many received massive government subsidy and could not walk away from their obligations.

Lastly, and at a very personal level, a number of hog firm founders and top executives borrowed millions using their own shares as a collateral. Stock price fall could trigger margin calls and forced sales. This was how Dr. Chen Junhai, founder of Kingsino, lost control of the company he founded.

StoneX Quarterly Update: A Look at China’s Largest Producers

Public hog firms release a large amount of information. Hundreds of stock analysts and huge number of active investors provide useful validation and helpful analysis. These insights are largely ignored by the US markets. Language barrier is a big reason. The other is the lack of interest. Since most US investors can’t open account to trade Chinese stocks or futures, they just don’t want to spend time on them.

On Friday, July 9 @1:30-3:00PM (CDT), I will be joined by Gavin McPherson of StoneX Group for a second webinar on China Hog Market update. I will provide an overview of all public traded Chinese hog firms and drill deep into the top-five producers.

Please email me (jimwenhuang@gmail.com) or Gavin (Gavin.McPherson@StoneX.com) if you are interested in this free, 90-minute webinar.

Have a great weekend.

[Declaimer: The material contained in this writing is for your information only, and may not be viewed as a recommendation to buy or sell securities. As of June 11, 2021, the author does not have beneficial ownership of any stock discussed in this writing.]

About the author: Jim W. Huang, CFA is a veteran of financial futures markets and consultant to a number of leading Futures and Crypto Exchanges. He is instrumental in the successful launch of China’s DCE Egg Futures (2013), DCE Soybean Meal Options (2017) and DCE Live Hog Futures (2021). Jim is a leading voice on China’s livestock and poultry markets, and frequently quoted by Bloomberg, Reuters and the Wall Street Journal. From 2001 to 2011, Jim was an Associate Director of Product Strategy at CME Group, the world’s largest Financial Exchange holding company. Jim received an MBA from Chicago Booth and studied under Nobel Laureate Eugene Fama in an empirical research paper of futures market liquidity. You may contact Jim by email at jimwenhuang@gmail.com.