Todd Thurman, Swine Insights International

January 30, 2024

This year I’m celebrating 25 years in the pork industry. I started my first full time job in the industry in May of 1999. It was a heady time. On my first day of work, I was issued a pager, a bag phone, a laminated paper list of important phone numbers and a laptop with a sticker on it that said “Y2K Compliant”. I’ll pause here for a moment while my younger readers Google “what is a bag phone?”

Those powerful tools, when combined with the irrational confidence of a 22 year old with a fresh college degree, seemed like all I needed to take the industry by storm. When I started, the industry was reeling from the worst financial losses in history that had occurred the previous year, 1998…a year that will live in infamy. It’s now 2024 and once again, the industry is recovering from the worst financial losses in history that occurred the previous year, 2023.

Many Changes

As you might expect, many things have changed in 25 years. In my first year in the industry, we gave awards to farms that achieved 20 PSY. Now 30 PSY is certainly respectable performance but not likely to win you an award. Artificial insemination was widely used, but not ubiquitous and nobody had heard of PCAI. Contract production was a thing, but it was maybe 15% of the industry, not ~80% as it is today. Multi site production had revolutionized the industry but it was almost all three site, the wean to finish concept had yet to take hold.

The industry was well into the integration and consolidation phase in 1999, in fact, acquisitions were the biggest stories of the year, but the top 10 producers only controlled 24% of the sows, double the percentage from just 5 years previous, but significantly lower than the 44% today. Perhaps the biggest change is the percentage of production that goes to export. Just 6.6% of pork produced in the US went for export in 1999. It is around 25% today.

Sow housing has certainly changed since 1999 when gestation crates were the standard and a few even still had tethers. Group sow housing was not even a consideration for most modern producers and the technology to do it the way most do it today didn’t exist. We were beginning to transition away from early weaning practices, but it was still a top of mind issue. My first project at my new job was to explore the benefits of weaning based on age instead of weight and it led to a huge discussion about how to add farrowing capacity to increase weaning age to 20+ days.

Some Things Haven’t Changed

Some things, however, haven’t changed much at all. Early in my career, I remember sitting in a meeting where we decided, “if we can get sow mortality under 10%, that would be great.” We did. We got it down to less than 5%, but 25 years later, in boardrooms around the industry, people are again saying, “if we could get our sow mortality under 10%, that would be great.”

In 1999, PRRS was the biggest health challenge, but we were worried about foreign animal disease…mostly FMD. In 2024, PRRS is the biggest health challenge, but we’re worried about foreign animal disease…mostly ASF, but also FMD.

The big news from the 1999 Pork Powerhouse list (the accompanying article could almost be reprinted today changing only the dates) was that Smithfield Foods, not even on the list in 1998, was ranked first after their purchase of number one producer, Murphy Family Farms, and several other smaller systems. In 2024, Smithfield still tops the list (and have every year since 1999), although now they’re under Chinese ownership.

Among the most frustrating things that hasn’t changed is per capita pork consumption in the US. In 1999, domestic per capita consumption was 52.1 lbs and was 51.1 lbs in 2022. Obviously, total pork consumption has increased over the years due to population growth, but that growth has slowed significantly and will likely continue to slow.

Industry at a Crossroads

In 2024, our industry is at a crossroads, a crossroads not unlike the one we faced in 1999. So, how have we survived the past 25 years? First, we have continued to consolidate, integrate and improve efficiency. Second, we have extended the useful life of many facilities beyond original intentions. Many of those sow farms that were in use in 1999 are still in operation today. Lastly, we have implemented contract production. This allowed companies to shift capital expenditure for wean to finish capacity to contract producers, who were happy to have it because they got a small dependable cash flow and access to the increasingly valuable manure as fertilizer for their crops.

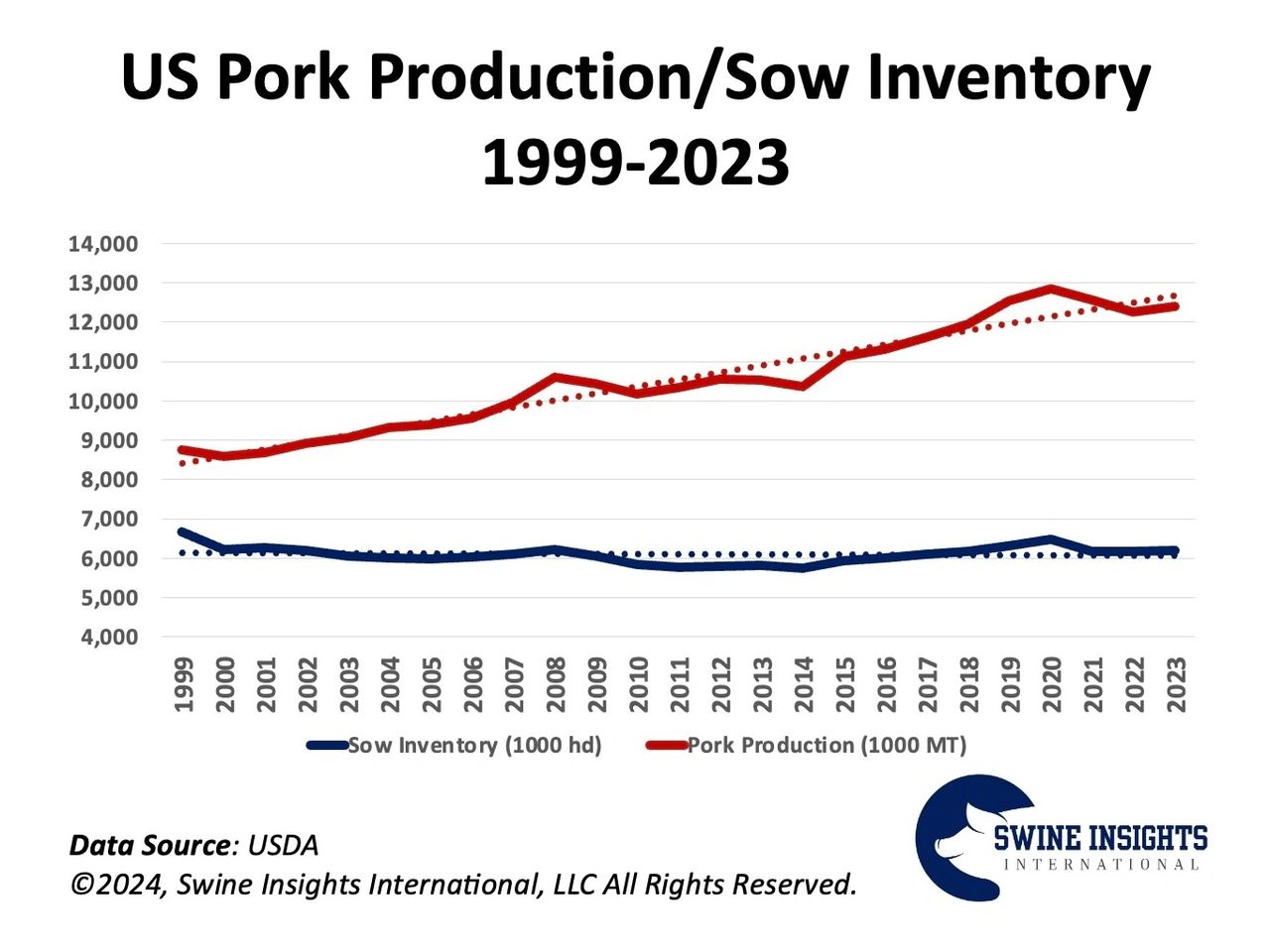

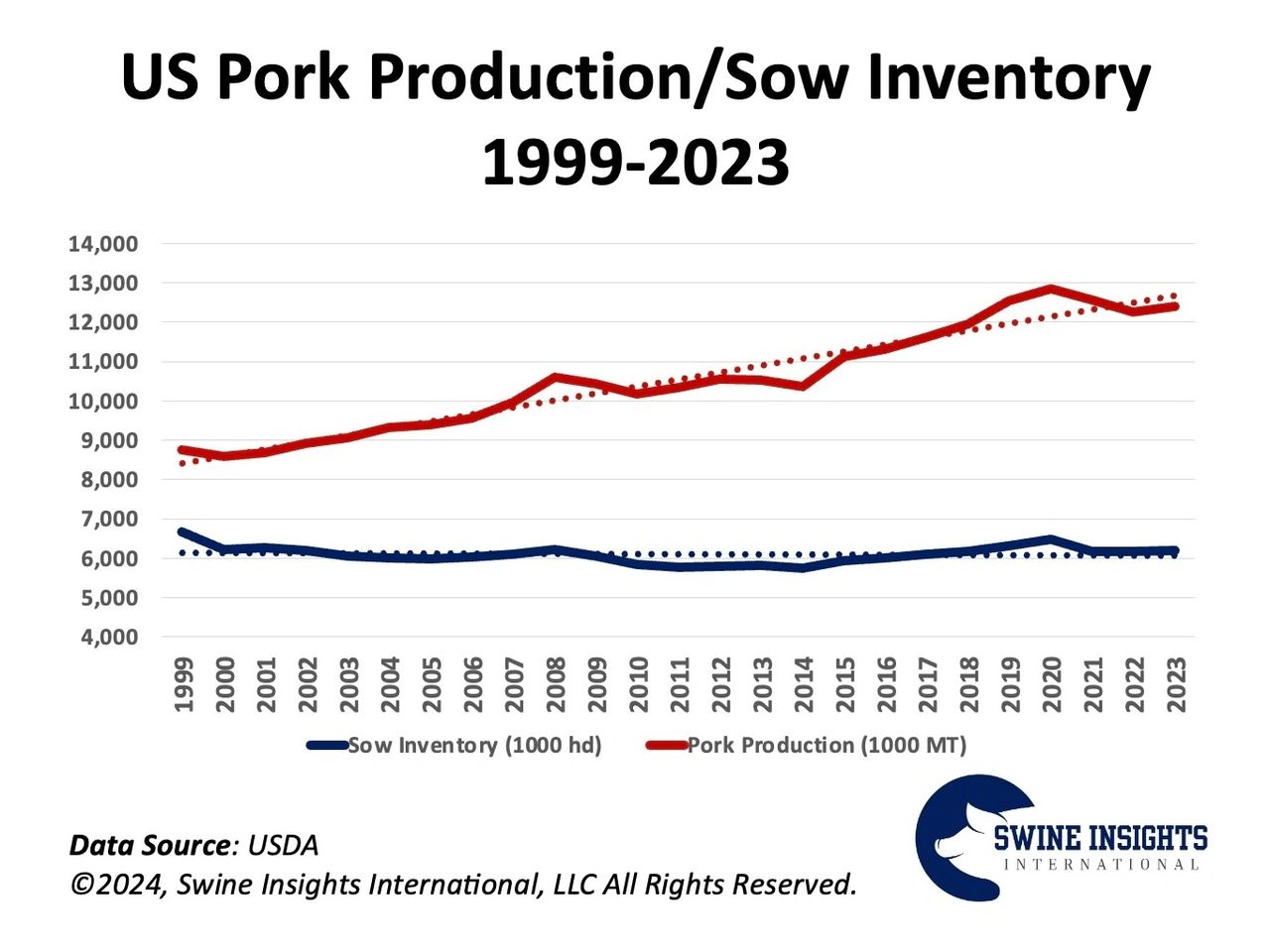

How sustainable are these practices? Well, consolidation, by definition, can’t go on forever. There’s certainly more room, but there are regulatory limits and diminishing returns. Further integration is certainly a partial solution, but if that’s the trend, it will be out of necessity not out of desire by packers to directly control more production. Can we continue to get more efficient? Sure, there are plenty of areas where we could improve, but we’ll have to be looking beyond litter size and market weight which are the two primary ways we’ve improved over the past 25 years. In both of those areas, the law of diminishing returns is becoming an issue. We also learned from Covid 19 that efficiency is not the only goal, resilience is an important consideration. Often, but not always, efficiency and resiliency are inversely related.

Can we continue to extend the life of already old facilities? Probably, but many of these farms are very old and some are becoming unsafe. I have a client who recently decided to shut down a sow farm because it was not able to be safely operated without massive investment, an investment he couldn’t rationalize in today’s reality. I did an informal survey of old timers in the industry at last year’s World Pork Expo asking what percentage of active sow farms were built in the 1990s or earlier. I got estimates all over the board, but I think it’s safe to say it’s more than 50%, likely significantly more. With today’s economics, I can’t see how a new sow farm makes sense and certainly attracting new money from outside the industry seems far fetched.

The last strategy I mentioned was contract production. I think contract production has been a great thing for the industry as whole. It has created fantastic opportunities for young farmers and allowed the integrators to grow without being tied down by the capital requirements of land and buildings. There are two problems moving forward, however. The first is that we are already about 80% contract production in the wean to finishing phase. The second is that contract production has shifted the value of the manure to the contract producers and away from the owners of the pigs. Over the last 20 years, the average per head value of the manure has exceeded the value of the pigs themselves. Recently, that value has been much higher, in the $10-$12 per head range. For an industry that hopes to profit $8-$10/head over the long term, that’s a lot of value to give away.

Forging Ahead

So, it seems clear to me that more of what got us here is not going to be enough to get us there. If we are going to avoid being back in this position again in another 25 years, we are going to have to think about things differently. We are going to have to come to the realization that in addition to the strategies I mentioned previously, in the last 25 years, we benefited from a demographic and economic sweet spot. Between 1998 and 2022, the global population grew at a rate of 1.28% per year. Much of that growth came in countries where pork is the preferred meat like China, South Korea and SE Asia. Not only did the population grow in these areas, the economic prospects of those people expanded dramatically allowing them to increase their per capita intake of animal proteins. In China alone, domestic consumption of pork increased from about 40 million metric tons to almost 60 million metric tons between 1999 and 2023. That difference of 20 million metric tons is the equivalent of two years worth of production for the entire US industry.

In the next 25 years, the global population growth rate will slow to about 1/5 the rate of the previous 25 years. Essentially of all of east Asia is projected to decline significantly and according to many demographers, the global population will be peaking around mid century. There will certainly be countries that continue to grow well beyond that period, but the vast majority of the growth will come from Africa and the Middle East and more than 60% of that growth will likely be Muslim. Furthermore, their ability to consume significant amounts of meat will be dependent on economic growth that has proven elusive for the region. While an economic miracle in Africa similar to China’s is not impossible, it’s far from certain.

The cold, hard truth is that as a global industry, we currently produce more pork than demand can support and we are producing more and more pork every year. Until we either increase demand or decrease supply, we are going to be stuck in a loop of steadily increasing volume of pork without the corresponding rate of growth in demand. Increasing demand should be a high priority for the industry. Improving the eating experience by adding back intramuscular fat is a way to both increase demand and increase margins, but the incentive structures will have to be realigned to make this happen.

Even if we’re wildly successful, however, increasing demand will likely not be enough. Population decline in key pork consumption countries will be a big hurdle to overcome. Combined with what appears to be a decreasing trend in per capita consumption in red meat in Europe, the treadmill continues to accelerate in the wrong direction. If that’s the case, we will need to develop a strategy to right size the industry and, more importantly, keep the industry right sized. That is a monumental challenge for a consolidated and integrated industry. It’s not like you can have a meeting of the top 40 producers and agree to cut production by X%, that would be against the law.

Solutions

What is required is a cultural shift for the industry away from the commodity mindset and more towards a consumer centric model. The commodity mindset was born of scarcity…the assumption that there’s never enough of whatever commodity you’re discussing. That has been mostly true for the entirety of human history, but, increasingly it’s not the case. Globally, we produce about 160% of the calories needed for a healthy diet. When we have plenty, there are only two ways to keep prices at a level that supports profitability…you can either cut production to re-create scarcity or you can increase the value of the commodity to increase demand.

If we fail to do the latter, the former will be forced upon us either by the ultimate reality of economics or by production quotas enforced by government. Neither are a pleasant result in my mind and both would create an industry that simply survives, not thrives. So, how long could we continue on the current path? The answer is very likely, “a lot longer than you might think.” We are an industry of tough, tenacious people and anyone who doubts our ability to keep getting up off that matt will likely be surprised. The reality is, however, that the longer we wait to address these fundamental issues, the more painful the ultimate transition will be.

It is my sincere hope that a new generation of industry leaders will emerge and begin to lay the groundwork for moving the industry towards are more prosperous and sustainable future. Making these changes will not be easy, but there will be rewards for those with the foresight to see the necessity of change. Those rewards will not just be financial, but will also be the knowledge that you played an important role in sustaining the industry we all love. I am trying to position my organization, Swine Insights International, to support this difficult but necessary transition and I hope others in the industry will join us.

I am extraordinarily thankful for this industry and all its great people. It has afforded me the opportunity to grow, develop and prosper while seeing the world and contributing in a small way to the miracle of the revolution that achieved what many believed impossible…feeding a rapidly growing global population. We are entering a new phase, however, and a new generation of industry leaders will need to call upon the wisdom of the giants of our industry’s past, but also develop new systems, tools and strategies to deal with new and emerging challenges. If we embrace these challenges head on, the next 25 years can be more prosperous than the last 25.

About the Author: Todd Thurman is an International Swine Management Consultant and Founder of Swine Insights International, LLC. Swine Insights is a US-Based provider of consulting and training services to the global pork industry. To learn more about the company, send an email to info@swineinsights.com or visit the website at www.swineinsights.com. To learn more about Mr. Thurman’s speaking and writing, visit www.toddthurman.me