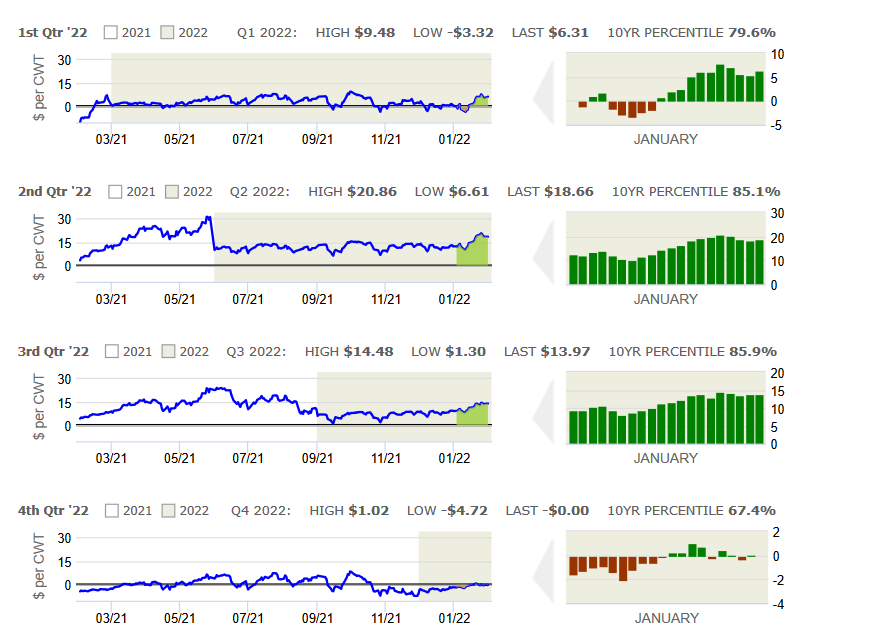

Margins surged over the second half of January as a continued rise in hog prices more than offset an increase in projected feed costs in forward marketing periods. Both cash hogs and pork continue to be supported by strong export demand along with strength in negotiated

prices despite rising harvest weights as slaughter and pork production continue to trail year-ago levels. Pork export sales have been robust the past few weeks despite uneven contributions from different countries. While sales to China have generally been underwhelming, last week they were near 17,000 MT which was the largest weekly volume since July of last year. After a slow start to the year, pork export sales to Mexico picked up last week with 17,300 MT booked for the week ending January 20. Pork export shipments of 30,681 MT were 13.4% higher than the most recent four-week average, but still down 23% from last year mostly due to lower shipments to China. Outstanding sales to China

of 31,668 MT currently represent 10.4 weeks of supply based on recent shipments. Pork in Cold Storage remains tight with total inventories of 493.9 million pounds at the end of December down 4.1% from last year and 19.1% below the five-year average. Negotiated cash hog prices have been volatile in the past two weeks, although lower slaughter and pork production levels from last year are supporting the market. Hog slaughter for the week ending January 28 is running 11.4% below last year while pork production is down 12.2% from 2021. Strength in cutout values have helped to support negotiated prices, where an increasing percentage of cutout value is now tied to cash hog price discovery. Our

clients continue to monitor margin targets in deferred periods to add protection with flexible strategies that allow for further margin improvement over time.

The Hog Margin calculation assumes that 73 lbs of soybean meal and 4.87 bushels of corn are required to produce 100 lean hog lbs. Additional assumed costs include $40 per cwt for other feed and non-feed expenses.