Highlights:

- China’s cash hog price declines 25% since January amid low pork demand;

- DCE hog futures is losing steam in a downward market;

- Government, public firms and private surveys depict a vastly different hog market;

- China’s impact on US pork markets, a free webinar in partnership with StoneX Group.

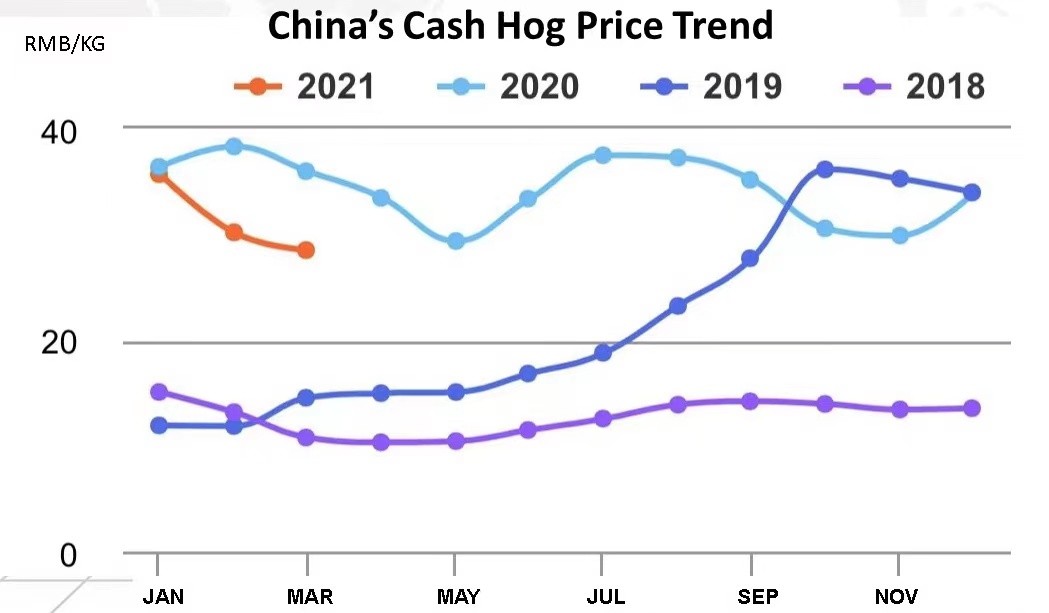

[Greene County IL, Mar 27] China’s cash hog price averages RMB 26.5 per kilogram on Saturday, down 26% from January level of 35.7, according to price data monitored by China-America Commodity Data Analytics. (Notes: US$1≈6.5 yuan, RMB26.45≈$4.07, and 35.68≈$5.49).

A Weak Cash Hog Season

Traditionally, Lunar Chinese New Year (CNY) is a peak meat consumption season in China. During the weeks-long holiday, restaurant traffic packs up by large banquets and group gatherings. Farmer’s market and grocery store sales skyrockets by food purchases for family reunion dinners. And gift exchanges among family members drive preserved meat sales to the highest level of the year.

However, this year’s holiday sales was very weak. With coronavirus in mind, Central Government encouraged people to stay where they were to celebrate the holiday, and not to do the annual ritual at their hometown. Local governments turned guidelines into rules restricting migrant workers from coming home. As a result of travel restrictions and social distancing practices, pork sales plummeted and price fell. February cash hog price of 30.2 was 21% lower than year-ago level.

Immediately following CNY is the trough season in cash hog market. Chinese consumers need a break from heavy meat diet during the holiday and switch to a lighter fare in the spring. Slaughterhouses and meatpackers cut back buying from hog farmers. Another factor is money. The biggest annual spending season drained the wallet of many consumers. They now need to work hard and spend less. Current cash hog price of 26.5 is 12% under February level, and 26% below March 2020 average.

Weak sales and low price are expected to persist throughout March and April. The next peak season will kick off on May 1, the International Labor Day long weekend.

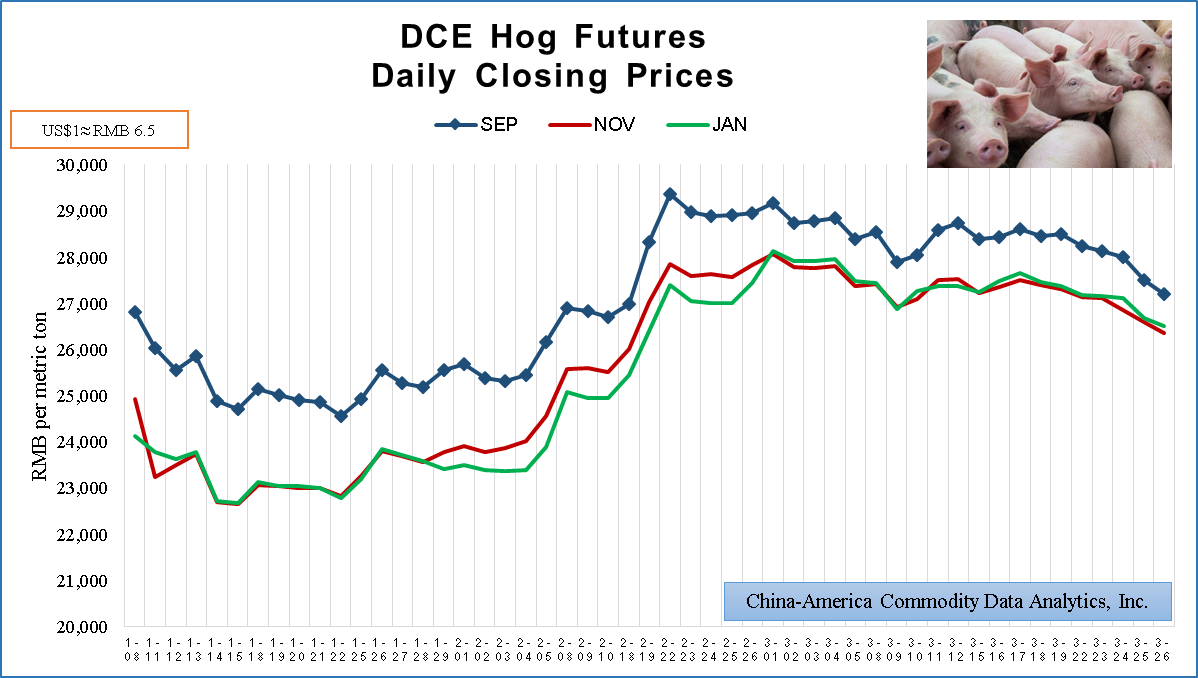

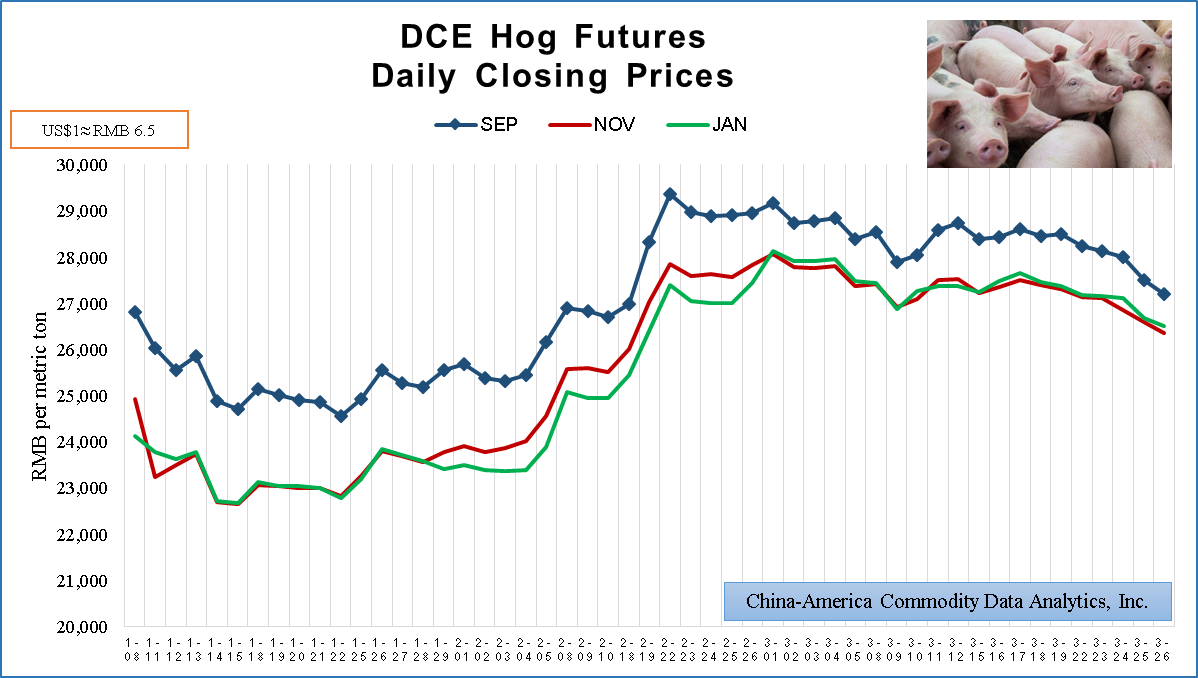

DCE Live Hog Futures Moves in Lockstep with Cash Hog Market

Front month September contract LH2109 closed at 27,215 Friday, down 305 points or -1.1%. The lead futures contract declined 4.5% for the week and lost 6.1% since the end of February.

November contract LH2111 ended at 26,365, and its daily, weekly and month-to-day changes were -0.9%, -3.5% and -5.3%, respectively. January contract LH2201 settled at 26,515 and fell 0.6%, 3.1% and 3.4% for the respective periods. With the latest cash hog price at 26.5 yuan per kilogram, or 26,500 in futures terms, DCE hog futures contracts are now trading very close to the cash market prices. (Notes: DCE hog futures is based on 16 metric tons of live hogs.)

Average Daily Volume in March to-date is 4,936 lots, down 55% from February ADV of 10,977 and -71% from January level. Open Interest on March 25 is 15,354 contracts, down 24% from the end of February and -6% from January 29.

Futures market speculators apparently lost interest in a contract trading at par. Commercial hedging has yet to take hold. Even with recent price drops, large producers still enjoy a sizeable hog margin. They are in the mood of “All-In” for expansion, and have not given risk management a serious thought.

Current State of Hog Industry: According to the Blind Men

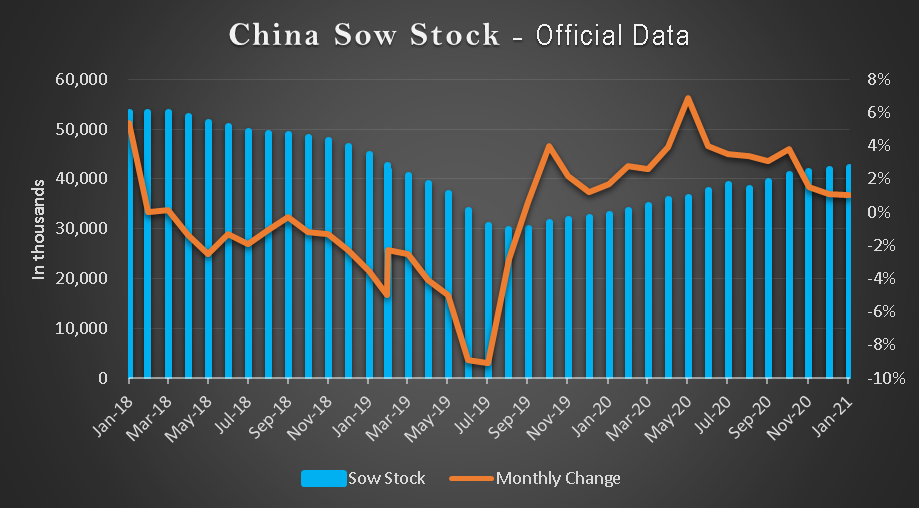

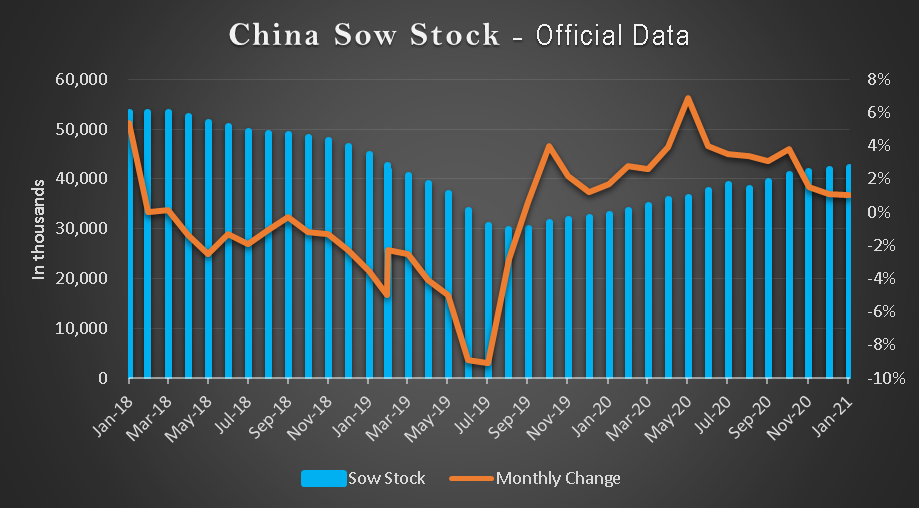

Ministry of Agriculture and Rural Affairs recently released sow stock data for February, which logged in the 16th consecutive months of positive growth. February data of 42.476 million was 1.0% above January level, and 42.1% more since African Swine Fever (ASF) reduced the country’s sow inventory to 29.9 million in September 2019.

Contrary to the rosy picture depicted by government officials, sow recovery is only half way through. February sow stock is still 20% below at the pre-ASF level three years ago in February 2018.

Sow data published by private agencies shows a very different picture. Yongyi Consulting, based in Shandong Province, argued that there was a loss of 4.99% in January, followed by additional decline of 4.68% in February in sow stock nationwide. Resurface of ASF cases and other winter-related diseases are to blame. SCI, another consultancy, showed a larger loss of 5.87% in January, but a rebound of 2.04% in February.

So, whose data is more accurate? After all, a different pace of recovery has significant ramifications not only for the hog industry in China, but pork and oilseed exporters in Americas and Europe, and for commodities markets which price in the data as well.

You are probably familiar with the parable of “The Blind Men and the Elephant”. Each blind man touches a different part of an elephant and comes to his own conclusion of what the elephant is like. The moral is that we like to claim absolute truth based on our subjected experience, and ignore other people’s limited experiences which may also be true.

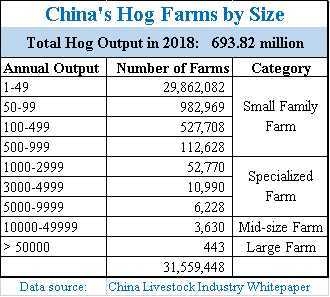

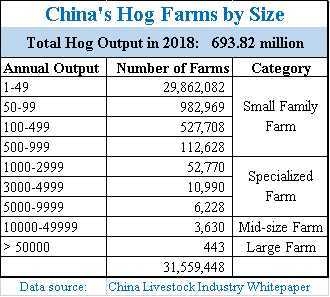

As of 2018, China has 31.5 million hog farms across 30 provinces in over 2,800 counties. No government or private agency has the ability to survey the entire industry in a timely fashion. They are like the blind men: each tells you the truth but not the whole truth.

Government agencies have the best vision of them all. Those hog farms mid-size and above are required to report production and inventory data to Ministry of Agriculture monthly. However, official data is not free of political interference, as we are well aware in China. Data from different agencies contradicts each other. Sometimes you could not add up provincial data to arrive at a country total, as the same agency may have different methodologies for provincial branches and at national level. In general, we just need to take it with a grain of salt.

Private agencies have a harder time collecting data from large farms. Their data samples are likely underreporting big farms but over reporting small farms.

In the last commentary (Large Chinese Producers Booked Record Hog Sales), we reported that 13 publicly traded Chinese hog firms released Jan-Feb performance data. Together, they sold 11.76 million hogs, up 145.59% from the same period in 2020. This giant farms represent 12%-15% of the hog industry, and have a very different trend comparing to small family farms.

Due to the limitation of hog and sow data, we would need to cross-check feed sales data reported by China Feed Industry Association, and slaughter data also reported by Ministry of Agriculture. Unfortunately, each dataset has its own limitation. Only 60% of the hog farms use commercial feed products. And small slaughterhouses are not being tracked and reported. I wish there were an easier way to understand hog data from China. But it takes a trained eye to examine its current state and uncover the whole truth.

China’s Impact on US Pork Markets

On Wednesday, April 7, I will join forces with StoneX Group to bring out a virtual feature presentation, titled “China’s impact on US pork markets”.

For an hour, I will discuss China’s Hog Industry, Impacts of ASF and COVID, DCE Live Hog Futures, Large Hog Firms in the Stock Market, and China Pork Market Outlook for 2021 and beyond.

This free webinar is hosted by Gavin McPherson, Senior Risk Management Consultant at StoneX. Gavin will present “Five Factors Impacting US Hog Production”, which covers feed value, pork exports, domestic demand, sow liquidation and labor issues.

Here is a direct link to the registration site:

https://event.on24.com/wcc/r/3042629/B27A84675DA009919EE07EE2893785D6

About the author: Jim W. Huang, CFA is chief executive of China-America Commodity Data Analytics, Inc., an independent agricultural commodity market consultancy. Mr. Huang is a leading voice on China’s livestock and poultry markets, and frequently quoted by Bloomberg, Reuters and the Wall Street Journal. Prior to starting CACDA in 2012, he was an Associate Director of Product Strategy at CME Group, the world’s largest Derivative Exchange holding company. Mr. Huang received an MBA from Chicago Booth and studied under Nobel Laureate Eugene Fama in an empirical research of futures market liquidity. You may contact the author by email at jimwenhuang@gmail.com.